CNBC's Emmie Martin caught my attention the other day when the digital platform tweeted her article about a 25-year-old who makes $100k. The article comes from their Make It series which purports to help you be "smarter about how you earn, save and spend your money". The subgenre appears to be a segment titled Millennial Money, which doesn't have a mission statement but features a few articles about millennials making various amounts of money and how they're able to get by with it with budgeting skills.

This particular article follows Trevor Klee, a 25-year-old self-employed tutor making $100k a year. Apparently, other young Bostonians can learn personal finances from how Trevor operates his budget, but if Millenial Money is supposed to share in the mission of making one smarter about how to earn, spend, and save then they shouldn't be using such an anomalous case.

A better model would have found a more average millennial earner who can scrape by in the city. Since I can't go to Boston and spend the time finding one of these I decided to take Trevor's spending habits and translate them to a more average millennial living in Boston.

Lessons in How to Save

It's important to first point out the ridiculousness of Trevor's situation. We'll leave aside the fact that a self-employed LSAT tutor makes $100k a year (even though this fact should absolutely astound people). According to TaxAct Trevor's income places him in a bracket where he's taxed 28% of his income, which leaves him with $72,000 post-tax disposal income. Trevor has a monthly spend of $6,000 a month. Take a closer look at the CNBC chart:Spending only $2,775 means Trevor is pocketing $3,225 in savings every month. This amounts to an annual savings of $38,700. I have no idea where this excess money is going. The article states that "Klee has around $43,000 put away" in total so he's clearly spending it somewhere. The article also says he only spends around $350 on a workspace and another $200 in marketing for his business. That's still $2,675 in pure savings every month!

Throughout the rest of this post, I'm going to demonstrate that any lessons learned from Trevor are highly unlikely to benefit the average millennial living in similar conditions.

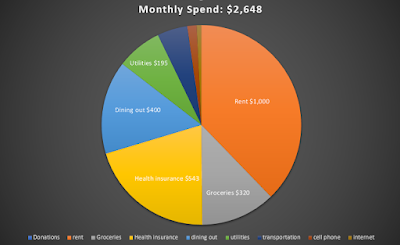

Based on some publicly available data and cowboy math here is the new spending breakdown I made for an average millennial in Boston (unlabeled categories are the same):

Earnings:

I thought I would be generous when considering the earning potential of our fictional self-employed millennial from Boston. The Bureau of Labor Statistics says 25 - 34-year-olds make just over $40k on average. I decided to go with the average salary for a college graduate which is $51,000 according to the National Association of Colleges and Employers because I'm not sure how anyone could even get by in Boston on $41k (though keep this in mind) and city earnings typically trend higher than national averages. The TaxAct tax bracket estimation is 25%, so we're looking at a monthly spend of $3,187.Without looking any further it seems our fictional average millennial could replicate Trevor's spending habits and still walk away with $382 in savings a month. Not great, but far from destitution (although not enough to afford a $550 workspace and marketing budget). However, I'm not convinced that the story of what Trevor spends on things like rent, healthcare, and food is all that average.

Rent:

Trevor splits rent as one of four roommates in a rental house. It seems that Trevor got lucky landing a monthly rent of $3,300 a month total, setting his rent at $825. I went to Zillow and pulled all the 4 bedroom rental homes in Boston. There were 50 up for rent and I eliminated the highest and lowest based on where Trevor would be likely to live (I'm assuming he wouldn't be in a neighborhood with a $17,000 rent, nor would he rent in a neighborhood where a 4 bedroom would cost $2500 a month). The average came down to $4,000 a month which means the average Bostonian renting a 4 bedroom house and splitting rent 4 ways would pay $1,000 a month, $175 more than what Trevor spends.Groceries and Dining Out:

Another unusual aspect of Trevor as a Millennial is how often he dines in. Seems he spends most of his food budget on groceries while only eating out on "a few meals each month" with his girlfriend. If we're looking to use the average millennial as our model to educate readers on spending habits we should note that a recent study by Bankrate shows over 50% of millennials eat out at least 5 times a week or more. We eat 84 meals a month (3 a day) and Trevor's total food budget is $650. Say Trevor eats five meals out a month, each costing around $50 (he says the meal ranges between $20 and $80 so this works) the other 79 meals (the ones he grocery shops for) cost just $5.Our average millennial probably isn't eating $50 meals every time they go out. So using the Boston Travel Guide I determined that an average high-end meal in the business district costs about $32 while the average low-end meal costs $8, making the average dining experience $20 a meal. If our average millennial eats out 20 times s month (5 times during the week) at $20 a meal we're looking at $400 a month. I left $320 for the remainder of our millennial's 64 meals (which each cost $5 based on CNBC/Trevor's estimation).

Of course, the obvious lesson here is maybe millennials should be more like Trevor and eat out less. This would increase the grocery cost, potentially evening out the cost, but it's probably more cost efficient and could subsequently save some money. Yet there is a good reason to believe that millennials making less money are eating out more because of the convenience, which is itself a cost-saving measure. As activist and writer Natalie Shure points out:

So while you may spend slightly less by prepping your own food the time invested in doing so is a cost you may not be able to afford. Given the scope of millennials going out to eat this is most likely the case. It isn't a particularly useful lesson from CNBC unless they plan on teaching us how to more efficiently shop. Nothing in the Millennial Money section offers a story like this.

Insurance:

While the CNBC article goes a little further in-depth about some of Trevor's spending habits I'm not entirely sure how he gets away with spending just $270 a month on insurance. At 25 he can be on his parent's insurance but it doesn't appear he went this route, so neither will our average millennial. Both Trevor and our average millennial are self-employed too, so they have no employer-sponsored health insurance (even though that amounts to over 50% of people covered in MA). The Kaiser Family Foundation tracks the average annual premium for Massachusetts at $7,031. Since our fictional millennial is self-employed like Trevor they are on the hook for all $585 a month.I did some hunting for plans and the closest I could find to the average was $543 a month. I couldn't find anything for $270 a month and unfortunately, the CNBC article makes no mention of how a self-employed or freelancing millennial could find the affordable insurance Trevor has.

What We Lose:

With the adjusted spend for average costs and average millennial habits I had to cut our millennial's contribution to a house cleaner ($30) and cut our donations to stay under budget enough to bring in $539 in savings a month, which still can't cover the the $550 a month for the workspace and marketing that Trevor can buy (he mentions the workspaces can cost up to $1500 a month when it's busy season). It also doesn't leave our average millennial with a lot of money to invest in a retirement account, buy clothes, pay off any debt (NBC News reports 77% of millennials have one or more forms of debt), buy Christmas gifts, buy their significant other dinner, and generally have some sort of social life. Seems the average millennial would have to make major sacrifices to their lives and businesses in order to budget the way Trevor budgets.What Did We Learn?

Trevor Klee's situation is niche. It seems he is able to be very savvy with money because he has an abundance of it and he makes sacrifices that other American's might not be able to make. Americans in other cities have to own cars and car insurance for example. What parts of the budget should we cut to pay for this? Many Americans don't want to risk spending less on a cheap insurance plan with less than quality coverage, does CNBC recommend we do this?The lesson for me is that austerity doesn't work. You cannot budget cut your way to prosperity and all of these millennial stories need to stop pretending like we can. What we need are large systemic changes that alleviate these strains on our material conditions. Things like:

- Medicare for All would reduce our average millennial's insurance costs to $0 with no sacrifice to coverage

- Rent controls could help keep the rents down so our millennial doesn't have to spend a 3rd of their paycheck on rent

- A 32 hour work week could allow for more time to shop for and prepare cost effective/healthier foods at home

- Robust public transportation to keep their transportation cost down (which actually could be a lesson you take from Trevor).